Kairos™

ParabolicSar - Parabolic Stop and Reverse

The Parabolic SAR calculates a trailing stop. Simply exit when the price crosses the SAR. The SAR assumes that you are always in the market, and calculates the Stop And Reverse point when you would close a long position and open a short position or vice versa.

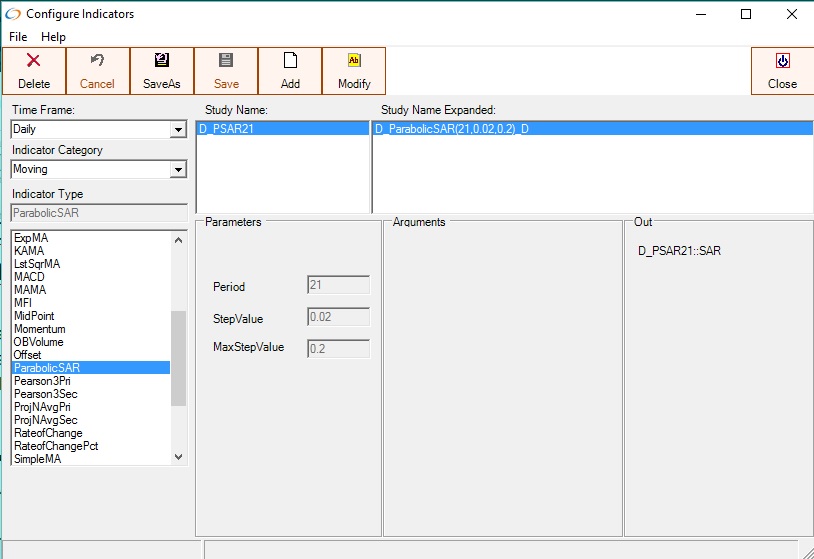

Above a Parabolic Stop and Reverse(SAR) is configured with a period of 21, initial step value of 0.02 and a MaxStepValue of 0.2

Chart displaying a Parabolic Stop and Reverse(SAR) on the daily timeframe