Kairos™

CFTPP - Chicago Floor Trader Pivot Points

This indicator is used by floor traders on Chicago Mercantile Exchange to calculate short term support and resistence levels for commodities. It consists of two support an two resistance levels.

PP = (High + Low + Close) / 3

(R1) First Resistence Level = PP * 2 - Yesterday's Low

(R2) Second Resistence Level = PP + Yesterday's Range (High - Low)

(S1) First Support Level = PP * 2 - Yesterday's High

(S2) Second Support Level = PP - Yesterday's Range (High - Low)

This indicator is configured only on the daily timeframe. The indicator outputs can be used with intraday indicators for entry conditions.

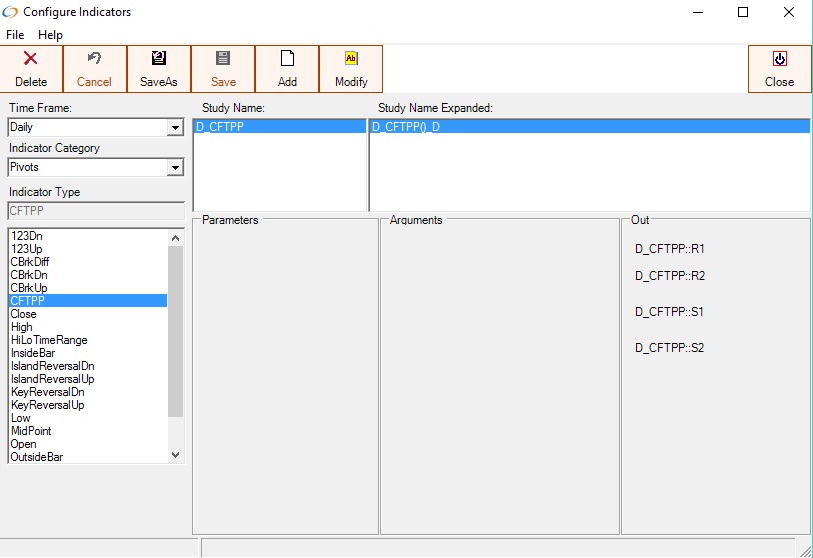

This is the Chicago Floor Trader Pivot Points(CFTPP) indicator configured on the daily timeframe

Above is a chart of the Chicago Floor Trader Pivot Points(CFTPP) indicator configured on the daily timeframe

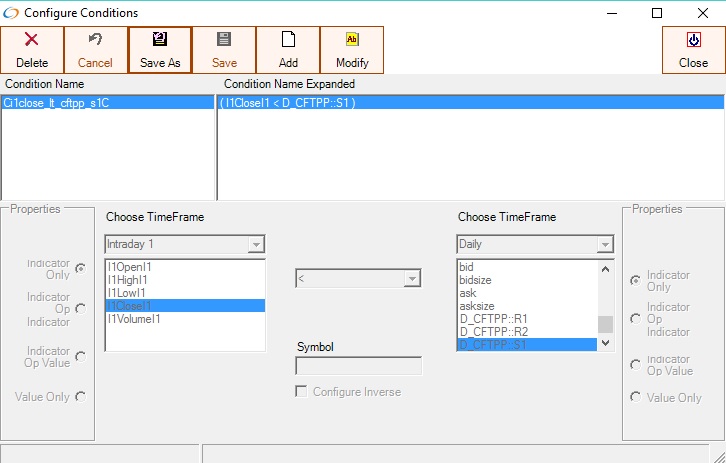

The Chicago Floor Trader Pivot Points(CFTPP) indicator can be used in conditions. The above condition tests if the 1 minute close is less than the Daily CFTPP first support level (S1)