Kairos™

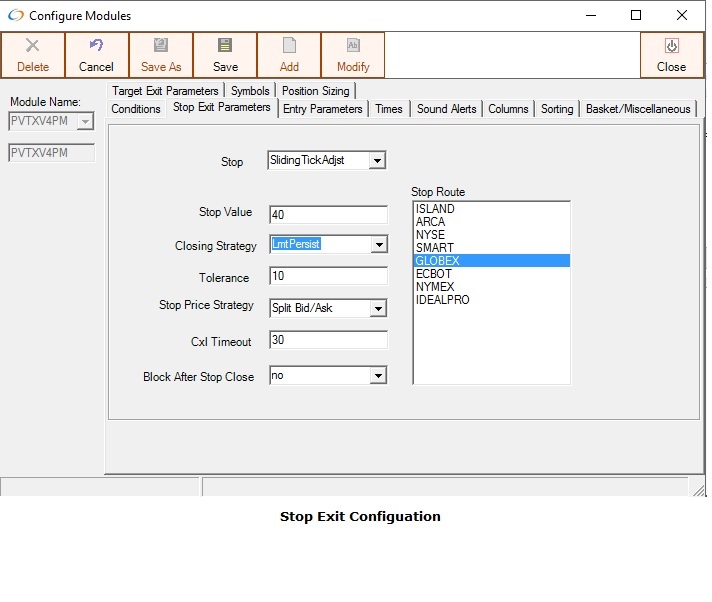

Config Modules - Stop Exit Parameters

Stop Exit Orders are initiated from automated positions that meet the Stop Criteria.

There are 21 types of Stop Exit:

- Fixed

- Stop Order is sent when the price trades at

- EntryPrice –StopValue

- Example EntryPrice = 50.00, StopValue – 0.5 , The Stop Exit Order would be sent when the symbol trades at 49.5(for longs)

- FixedAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the stop is tightened(Adjusted)

- Initial Stop Order is sent when the price trades at

- EntryPrice – StopValue

- Example EntryPrice = 50.00, StopValue = 0.5

- The Stop Exit Order would be sent when the symbol trades at 50 – 0.5 = 49.5(for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.25

- Stop after initial target hit would be 50 – 0.5 * (1/2) = 50 – 0.25 = 49.75(for longs)

- FixedToSldAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the stop is tightened(Adjusted) AND converted to a sliding stop

- Initial Stop Order is sent when the price trades at

- EntryPrice - StopValue

- Example EntryPrice = 50.00, StopValue = 0.5

- The initial Stop Exit Order would be sent when the symbol trades at 50 – 0.5 = 50 – 0.5= 49.5 (for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.125

- If the first target was 50.25, then the next stop would be 50.25 – 0.5 * (1/2) = 50.25 – 0.25 = 50(for longs), making it effectively a break even trade once the first stop is hit

- Once the first target has been hit, it is converted to a sliding stop, to protect any further gains.

- FixedPct

- Stop Order is sent when the price trades at

- EntryPrice – EntryPrice * (1 – StopValue/100)

- Example EntryPrice = 50.00, StopValue = 0.5 , The Stop Exit Order would be sent when the symbol trades at 50 – 0.005 * 50 = 49.75(for longs)

- FixedPctAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the stop is tightened(Adjusted)

- Initial Stop Order is sent when the price trades at

- EntryPrice – EntryPrice * (1 – StopValue/100)

- Example EntryPrice = 50.00, StopValue = 0.5

- The Stop Exit Order would be sent when the symbol trades at 50 – 0.005 * 50 = 50 – 0.25 = 49.75(for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.125

- 50 – 0.005 * 50 * (1/2) = 50 – 0.125 = 49.875(for longs)

- FixedPctToSldAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the stop is tightened(Adjusted) AND converted to a sliding stop

- Initial Stop Order is sent when the price trades at

- EntryPrice – EntryPrice * (1 – StopValue/100)

- Example EntryPrice = 50.00, StopValue = 0.5

- The Stop Exit Order would be sent when the symbol trades at 50 – 0.005 * 50 = 50 – 0.25 = 49.75(for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.125

- If the first target was 50.125, then the next stop would be 50.125 – 0.005 * 50 * (1/2) = 50 – 0.125 = 50(for longs), making it effectively a break even trade once the first stop is hit

- FixedDollar

- Using the StopValue as a dollar amount, when the loss reaches the dollar amount of the StopValue, the StopExit order is sent

- Example: For an EntryPrice of $50 and a StopValue of $150 and a Position Size of 1000 shares, the Stop Exit Order would be sent at a price of 49.85

- FixedDollarAdjst

- Used with a Target Strategy of ‘ScaleOut’

- For the initial stop, using the StopValue as a dollar amount, when the loss reaches the dollar amount of the StopValue, the StopExit order is sent

- Example: For an EntryPrice of $50 and a StopValue of $150 and a Position Size of 1000 shares, the initial Stop Exit Order would be sent at a price of 49.85

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of $75

- If the first target was 50.125, then the next stop would be 50 X1000 – 150 * (1/2) = (50000 – 75 )/ 1000 = 49.93

- FixedDollarToSldDlrAdjst

- Used with a Target Strategy of ‘ScaleOut’

- For the initial stop, using the StopValue as a dollar amount, when the loss reaches the dollar amount of the StopValue, the StopExit order is sent

- Example: For an EntryPrice of $50 and a StopValue of $150 and a Position Size of 1000 shares, the initial Stop Exit Order would be sent at a price of 49.85

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of $75

- If the first target was 50.125, then the next stop would be 50.125 X1000 – 150 * (1/2) = (50125 – 75 )/ 1000 = 50.05.

- Once the first target is hit and the stop is reduced, it becomes a sliding stop

- FixedTick

- Stop Order is sent when the price trades at

- EntryPrice –StopValue in ticks

- Example EntryPrice = 50.00, StopValue = 8, with each tick 0.25 , The Stop Exit Order would be sent when the symbol trades at 50 – 8 * 0.25 or 48(for longs)

- FixedTickAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the stop is tightened(Adjusted)

- Initial Stop Order is sent when the price trades at

- EntryPrice – StopValue in Ticks

- Example EntryPrice = 50.00, StopValue = 8 ticks with a tick value of 0.25

- The Stop Exit Order would be sent when the symbol trades at 50 – 8 * 0.25 = 48(for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.25

- Stop after initial target hit would be 50 – 8 * 0.25 * (1/2) = 50 – 1 = 49 (for longs)

- FixedTickToSldAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the stop is tightened(Adjusted) AND converted to a sliding stop

- Initial Stop Order is sent when the price trades at

- EntryPrice – StopValue in ticks

- Example EntryPrice = 50.00, StopValue = 8 ticks, with each tick worth 0.25 points

- The initial Stop Exit Order would be sent when the symbol trades at 50 – 8 * 0.25 = 48 (for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 4

- If the first target was 51, then the next stop would be 51 – 8 * 0.25 * (1/2) = 51 – 1 = 50(for longs), making it effectively a break even trade once the first stop is hit

- Once the first target has been hit, it is converted to a sliding stop, to protect any further gains.

- Sliding

- The StopExit Price is calculated the same as Fixed, however as the price moves in a profitable direction, the stop moves up as well

- Example: EntryPrice = 50, StopValue = 0.5 – When the price moves to 50.25, the Stop Exit Price moves up 49.75. When the price moves to 50.5, the Stop Exit Price moves up to 50

- SlidingAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the sliding stop is tightened(Adjusted)

- Initial Stop Order is sent when the price trades at

- EntryPrice – StopValue

- Example EntryPrice = 50.00, StopValue = 0.5

- The Stop Exit Order would be sent when the symbol trades at 50 – 0.5 = 49.5(for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.25

- Assuming an initial target of 50.5, the Stop after initial target is hit would be 50.5 – 0.5 * (1/2) = 50.5 – 0.25 = 50.25(for longs)

- The sliding stop of 0.25 is used until the position is stopped , another target is hit or exit criteria is met.

- SlidingPct

- The StopExit Price is calculated the same as FixedPct, however as the price moves in a profitable direction, the stop moves up as well

- Example: EntryPrice = 50, StopValue = 0.5 . The sliding stop is 50 * 0.5 / 100 = 0.25. When the price moves to 50.25, the Stop Exit Price moves up 50. When the moves to 50.5, the Stop Exit Price moves up to 50.25

- SlidingPctAdjst

- Used with a Target Strategy of ‘ScaleOut’

- For the initial stop, using the Stop Value as a percentage of the Target Value

- The StopExit Price is calculated the same as SlidingPct, however when the first scaleout target is hit, the stop is tightened or adjusted.

- Example: EntryPrice = 50, StopValue = 0.5 . The initial Stop Exit Price would be at 50.75

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.125

- If the first target was 50.125, then the next stop would be 50.125 – 0.5 * 50 * (1/2) / 100 = 50.125 – 0.125 = 50

- The reduced sliding stop of 0.125 is used until the position is stopped out, the next target is hit, or exit criteria is met.

- SlidingTick

- Initial Stop Order is sent when then price trades at

- EntryPrice - Stop Value in Ticks

- As the Price moves in a profitable direction, the stop moves up as well.

- Example: EntryPrice = 50, StopValue = 8 ticks with 0.25 per tick – When the price moves to 52, the Stop Exit Price moves up 50. When the moves to 52, the Stop Exit Price moves up to 52

- SlidingTickAdjst

- Used with a Target Strategy ‘ScaleOut’

- As position is scaled out profitably, the sliding stop is tightened(Adjusted)

- Initial Stop Order is sent when the price trades at

- EntryPrice – StopValue in ticks

- Example EntryPrice = 50.00, StopValue = 8 ticks

- The Initial Stop Exit Order would be sent when the symbol trades at 50 – 8 * 0.25 = 48(for longs)

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of 0.25

- Assuming an initial target of 52, the Stop after initial target is hit would be 52– 8 * 0.25 * (1/2) = 52 – 2 = 50 (for longs)

- The sliding stop of 4 is then used until the position is stopped , another target is hit or exit criteria is met.

- SlidingDollar

- This setting uses the same calculation as FixedDollar, except it moves the stop up as the Price moves up

- Example: For an EntryPrice of $50 and a StopValue of $150 and a Position Size of 1000 shares, the initial Stop Exit Order would be sent at a price of 49.85. As the Price moves up, so does the stop – when it reaches a price of 50.08, the stop is moved up to 49.93. When it reaches 50.5, the stop is moved up to 50.35 and so on.

- SlidingDollarAdjst

- Used with a Target Strategy of ‘ScaleOut’

- For the initial stop, using the Stop Value as a dollar amount, when the loss reaches the dollar amount of the StopValue, the StopExit order is sent.

- Example: For an EntryPrice of $50 and a StopValue of $150 and a Position Size of 1000 shares, the initial Stop Exit Order would be sent at a price of 49.85

- Assume that there are two targets configured in Scaleout

- After the first target is hit, the stop is adjusted by the percentage that the position is reduced by. For example, 50 % of the position is sold at the first target, the stop is tightened by 50%, which would make it a stop value of $75

- If the first target was 50.125, then the next stop would be 50.125 X1000 – 150 * (1/2) = (50125 – 75 )/ 1000 = 50.05

- The reduced sliding dollar amount of 75 is used until the position is stopped out, the next target is hit, or exit criteria is met.

- sllt50

- This is a combination of Sliding and SlidingPct settings. For equities> 50 it calculates a SlidingPct stop using the StopValue. For symbols < 50, a StopValue of 0.5 is used(regardless of the StopValue setting)

Block after Stop Close

Some Entry Conditions are broad and a symbol may be alerted in the module window for a period of time, however an Entry Order is sent the first time the symbol appears in the Module Window during Valid Entry Times range. It’s possible for the position to be stopped out but the entry condition may still be true resulting in an immediate reentry after a stop out. The Block after Stop Close setting is used for these situations

This setting becomes effective after the position is stopped out. If set to “yes”, then this symbol is blocked from any further entries from the module for the rest of the day, even if the entry condition is true. After the Stop Exit the symbol is placed in the Blocked Symbols List . If you want to override the symbol being blocked, then remove it from the Blocked Symbols list

If set to “no” then the symbol will reenter after a stop close whenever the entry condition is true within a Valid Entry Time range